Here is my latest column for IBA Global Insight:

Here is my latest column for IBA Global Insight:

After months that have seen widespread demonstrations, bloodshed, Russia’s annexation of Crimea, snap elections and ongoing turmoil in Ukraine, it is easy to forget that it was the decision by former President Viktor Yanukovych to pull out of a much-anticipated trade pact with the European Union that sparked the protests in the first place.

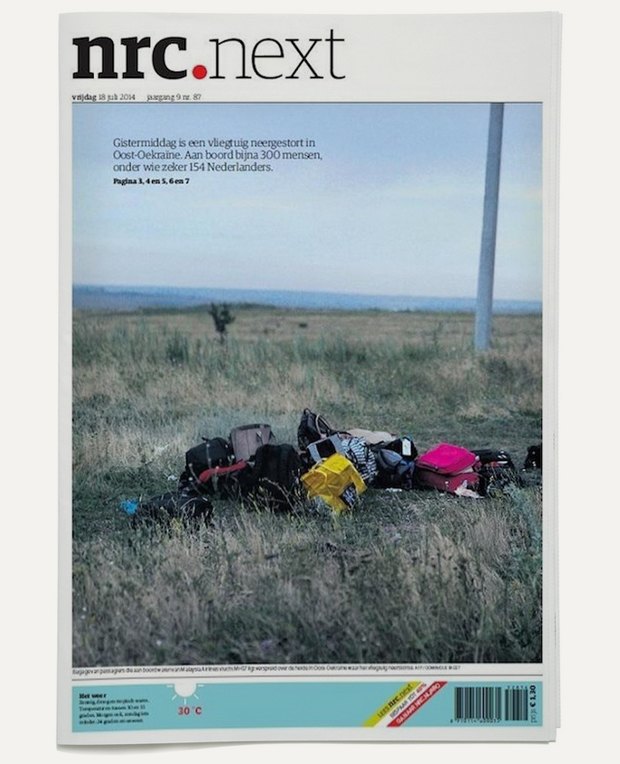

Wind on nine months and the EU has signed an association agreement with Ukraine, Georgia and Moldova. Russia has also forged ahead with expanding its own trade relationships and signed the Eurasian Economic Union (EaEU) with Belarus and Kazakhstan. As the fallout from the tragic downing of flight MH17 over Ukraine on 17 July continues and relations across the EU and beyond become increasingly strained, the question remains: is it always better, together?

Lourdes Catrain, Vice-Chair of the IBA International Trade and Customs Law Committee and director of Hogan Lovells’ European international trade and investment group, believes the June association agreement signed between the EU and Ukraine is a significant step for European trade relations. ‘It’s important to remember that it was the proposed Ukrainian association agreement with the EU that triggered the Russia-Ukraine crisis, and which shows that Ukraine has made a strong bet for the EU,’ she says.

‘The association agreement with the EU shows that at least, a very large part of the population in Ukraine is prepared to follow the EU. Given the size of Ukraine that’s an important message. [Although] Georgia and Moldova have much smaller economies, it’s significant that the three of them have joined what could become a very deep association with the EU.’

Published on 04-08-14. Read on here