Widespread condemnation of Russia’s military invasion of Ukraine was quickly followed by unprecedented economic sanctions.

As foreign investors and businesses rushed to sell off assets, close offices and cut ties with clients in Russia, an uneasy realisation dawned. Something known in the anti-corruption community for decades: the wealth and business interests of hundreds of oligarchs closely aligned to the Putin regime is fully embedded in the world’s financial centres.

Wealthy Russians have, over the past 20 years or more, listed their companies on stock exchanges, bought lavish properties, invested in trophy-winning football clubs and so on.

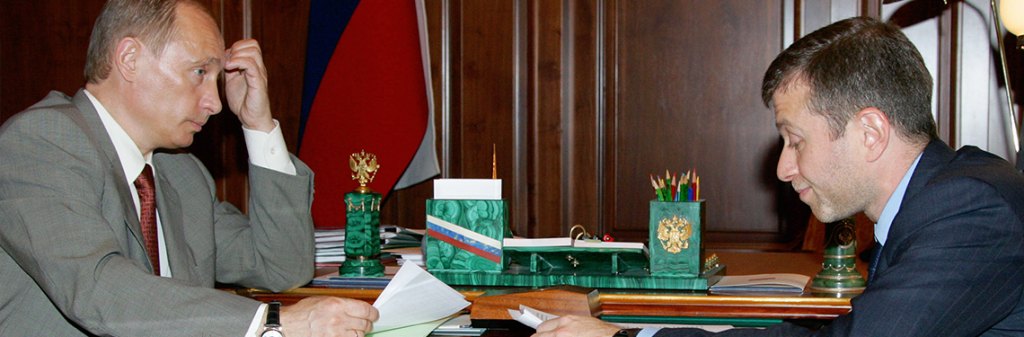

It wasn’t a secret. Oligarchs had been laundering their illicit wealth in plain sight. Worse still, governments time and again had stood idly by and let it happen. ‘Sanction the oligarchs!’ was the rallying cry of Bill Browder, CEO of Hermitage Capital Management and vocal critic of Russian President Vladimir Putin, for more than a decade.

Published on 22.03.22. Read on here